Grow Rich by Handling Your Money & Investments

I am very opinionated when it comes to money and investing, so first off: this is not advice to you, it is merely the things I use. So why do I feel like I get to talk about finance? Well, either the universe set up a couple of very unlikely coincidences, or I learned some things many people never do. Maybe both. Over the past years I have:

- Gotten advice from a billionaire's personal financial advisor

- Made a 5000% return on some investments (student at the time, not set for life just yet)

- Read a handful of powerful books on finance, see summary of one here

Me? I'm not a pro. I do however listen to the pros. Here's what I learned. This post is also available as a podcast.

Four realizations I had that woke me up

‘The rich get richer’ is good for me

Let’s say you are standing in front of a mountain. If you manage to climb the mountain you will instantly become so wealthy, you never have to work again. There are two guides at the bottom of the mountain who offer you their services:

- One guide tells you: ‘With me the beginning is easy, but it gets harder later on’

- The other says: ‘With me the longer we climb the easier it gets!’

Personally I would take the second guy any day. I mean, it’s like a marathon where the running only gets easier! What a lovely world that would be… When people say ‘the rich get richer’ often this is said in a negative tone. To me it simply indicates that apparently if I find the right guide, I can make my financial wealth grow faster the more I earn, hell yes! The thing is, there are many people on this planet who make plenty of money but don’t automatically grow richer. What matters is not just the money you have, but what you do with it.

A proper budget makes you feel free, not restricted

My first serious considerations about finance started when I was a student living on a government loan. When money is tight, you realize how limiting money can be. After paying for rent, food and tuition I had very little money left. However, I am too stubborn to ask my parents for financial help. Ok, maybe I did ask my mom for some food money in my second month… I started trying budgeting apps and realized that to my utter surprise, using them made me feel more financially free! Suddenly I had zero anxiety about whether or not I had money for food, fun or expenses. Defining up front what I wanted to spend didn’t make me feel limited at all. It’s kind of like having a healthy diet. Some people think a healthy diet makes you feel restricted as if you are punishing yourself. The truth is that it makes you feel a lot better, and soon enough you stop craving bad foods. And even if you do a splurge once in a while is perfectly fine. Finance is the same.

Finance and investing is not complicated, people just make it seem so

As I researched financial best practices, something very confusing happened: all the role models (actually rich, not deep in debt) I was looking at used the same or very similar strategies. And the strategies were dead simple! I thought for a long while I must be missing something, but after reading ‘Money: Master the game’ I came to the conclusion that indeed finance doesn’t have to be complicated. The one thing that pushed this for me is that during a summer program called Draper University, the financial manager of billionaire Tim Draper came over and for an hour told us how he managed Mr. Draper’s money. Guess what, that was the same as the stuff I read later on it books. Should have known…

Money is your employee

If you consider every euro/dollar/rupee/whatever to be an employee of yours, a number of things change drastically. Just imagine having 1000 employees and have them sit still in a room for a year, that would make no sense! However, that was what I was doing, leaving my money on an account with an interest rate barely equal to inflation… Likewise, now having a budget is like running a company and not giving your employees jobs to do. They will end of messing around and being unproductive. But that is what you do when you do not have a budget.

'Money for life' is not that much

This part is very important, and actually not as overwhelming as it seems. Most people when thinking about retirement think of a pile of money they will slowly consume until they die. That however is an unproductive view, instead you should strive to love off of the interest of your investments. For example, I know that at a historically conservative 5% market ROI €400,000 will net me €400,000 * 5% = €20,000 income on a yearly basis. Make a list for yourself where you calculate how much you need to:

- Survive

- Live well

- Live your dream

For me, assuming 5% market performance:

- I can survive my current living standards on rent + food, which equals about €1000 a month, which is €12,000 a year. For that I need only €240,000 which is totally achievable.

- I can live well on €1500 a month, which requires €360,000

- I can live, travel and buy any toys I want for €3000 a month which requires €720,000

Am I aiming to grow far beyond that? Yes, but it is nice to know that if I save well and reach €240,000 I would basically stop working and live like a king in a nice south American country. Of course this assumes 5% ROI which right now seems low but historically is pretty reasonable. Think long term…

Section 1: Managing money day to day

I started as a broke student. Now I make more than most people my age and quite a few above. The only reason though that I manage to build up money is that I started as a broke student, so I learned to use a financial structure when I felt like I didn’t need one, or didn’t have enough money for it to matter. Lesson: start now. Doesn’t matter whether you have €100 or €100,000.

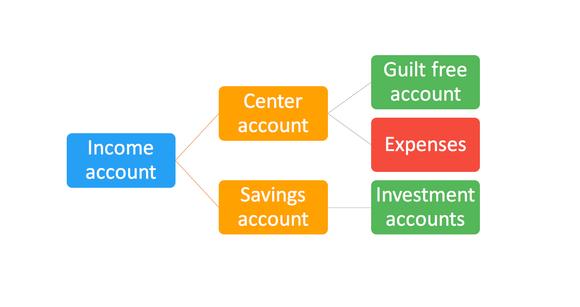

Have at least three bank accounts

Managing money for me is about compartmentalizing. While I was a student I created the following structure and have stuck by it:

- A central account where income and expenses are managed from

- An account I call ‘guilt free’ which I can spend on whatever

- A savings account

I later added investment accounts, we’ll consider those later. The rules for the accounts are simple:

- Central: only income and automated expenses like rent. Never holds more than €10,000. Never carry this card on you.

- Guilt free: for food and fun. Never holds more than €100-€300. This is the card you carry around.

- Savings: holds the financial buffer that represents 6 months of expenses and non invested savings. This account should be rarely/never accessed.

Automate everything possible

If you need to think about money, you failed. Your finances should run themselves as much as possible. For me that means:

- An automated transfer for rent (center account)

- An automated transfer for utilities (center account)

- An automated transfer for food (from center to guilt free card)

- Automated transfers to my low risk investment accounts

Make this as fool proof as possible. This is one of the uses of the guilt free card. It makes sure that the big important transactions happen in isolation while small inconsequential transfers happen on a small flexible account.

Cut out harmful financial habits

Let’s do some math on habits that seem very small. Some fun ones would be smoking, having coffee out and eating lunch out. On a 50 week basis (year minus holidays):

- Smoking expenses will range from €5 to €30+ depending on habits. Let’s take €10 a week, which is €500 / year

- Coffee (€3) 5 times a week means 3550 = €750 / year

- Lunch (€15) 5 times a week means 15550 = €3750 / year

Now you can argue these numbers to be higher or lower, but the fact is that these expenses add up even more.

As we will discuss later, over the course of 40 years if well invested (assume 5% ROI) the savings of not doing these habits could grow to:

- Smoking: € 63,919,88

- Coffee: € 95,879.82

- Lunch: € 479,399.11

Please, read that again.

Ok, now read that again. AND AGAIN.

That would be the miracle of compound interest, something we will cover in the investment section. The above numbers are why I laugh really hard at people who smoke and eat or drink out because of social convention.

Have your cigarettes and coffee, I’ll take my millions thank you very much.

This is the code used for these calculations (javascript):

Balance cost and pleasure

Yes, I could live a lot more frugal than I do. But I still drink good wines, Matcha tea and spend well on food and holidays. The question you need to ask yourself is:

If I do not do X, will I feel good about it tomorrow?

Fill you feel good about it tomorrow if you make coffee at home instead of buying it overpriced? Will you feel good about not smoking? Probably.

Will I personally feel good about it if I spend no money on a holiday? Or on good and healthy foods? No. So I spend on those things.

Nobody can make these decisions for you, you need to take out your mental scales and with every expense ask yourself: will my future self thank me for this?

Make a budget and enjoy it

Budgeting is about fun and freedom. I love doing my monthly budget. Since I put myself on the right track making a budget makes me feel:

- Excited about seeing how long I can love about working

- Graceful for what my last month’s self managed to save for current me

- Good about myself for budgeting in freedom for my future self

I smile making a budget, and I have done so ever since my broke student self. It taught me that not having enough money means I need to reconsider my income sources and spending, and that being nice to my future self is very fulfilling.

I highly recommend using a piece of software called YNAB (You Need Budget). I’ve been using and loving it for years.

Section two: The principles of investing

Again let me remind you: this is only what I do, it is not financial advice for you specifically. Do your own research. I never tell friends what to invest in, I do however liberally share the things I do when people ask.

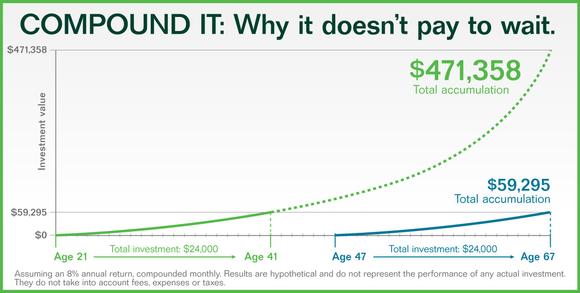

Understand the magic of compound interest

Remember those numbers at the cutting out habit section? They seem a tab high to most people. For the sake of fun ask yourself how much money the below things will grow to.

- 500 over 40 years at 5% interest

- 5000 over 40 years at 5% interest

- 5000 over 40 years at 7% interest

Here we go:

- €3,519.99

- € 35,199.94

- € 74,872.28

If those numbers seem high to you, that makes total sense. Einstein basically called compound interest a force of magic. Humans are simply not equipped with the minds to handle compound thinking.

What happens in compound interest is the following: the interest you get is not only over your initial money, but also over the interest of last time. Basically the longer you grow the faster you grow. That’s the whole ‘rich grow richer’ thing.

Fees also compound!

When getting investment accounts of products pay very very close attention to your fees. See how a few percent can grow to a massive amount of money? A 5% fee will also grow to a huge amount. Always use low cost financial products!

Diversification is important

Diversification basically means not putting all your eggs in one basket. You could for example pour all of your life savings in stocks of a specific company. Thing is that if that one company fails you are royally in trouble.

Diversification means that you put your money in different type of investments so that if one of them fails or does less well than you hoped you are still doing well. One way of diversifying is using index funds (see below).

Use cost averaging

This protects you from being disadvantaged by temporary swings in the price of investments. In essence it is diversifying over time.

In practice this means you should invest multiple times a year (I do monthly automatic investing) instead of buying a big bulk once a year.

Bonds and index funds are important & easy to understand

These are the two most important financial products I use. They are super simple!

As a general rule bonds are less profitable but more stable and index finds more high risk but higher yield. Note though that these are just rules of thumb and conventional wisdom.

Bonds

A bond is an organization (usually a government) saying: “give me €100 now and next year I will give you €105”. A 5-year government bond for example is basically saying: “give me €100 now and in 5 years I will give you €110”.

The value of a bond also depends a little on how much people trust a government to actually pay. I’ll for example gladly choose German bonds, not so much for Greek ones…

Index funds

An index fund basically buys stocks of companies that are market leaders and often very dependable. Basically this is betting on the horses that have won most often. It’s not very exciting, but relatively dependable.

An index fund tracking the US market for example might buy stocks in the 500 most successful companies. An emerging market index fund might buy stocks of the leading companies in emerging economies.

When people talk about how ‘the market’ is doing, often they are talking about index funds. These funds reflect how well the market is doing as a whole.

Index funds of bonds

Yes, these are a thing. Basically this is one fund that represents a combination of the most reliable bonds in a region.

The ‘EU Bonds index fund’ covers the most trustworthy EU bonds whereas the ‘World bond index fund’ covers the most trustworthy countries on the world.

Note on mutual funds

So mutual funds are basically funds that actively trade and make investment decisions. These people are professional stock brokers and call themselves financial experts. If you still believe in that I have three pieces of advice:

- Consider that last time I checked more than 95% of mutual funds do not beat the market (index funds) over time. They just have a good year once in a while and advertise the hell out of it.

- Watch ‘The Wolf of Wall street’ and consider that is based on an actual person

- Watch ‘The Big Short’ and consider that the people in the business have NOT changed since then

Think long term

Personally I learned this lesson in the Bitcoin bubble while I was a student. Unexperienced stock traders do irrational things.

Let’s say an index fund is doing well. People see rainbows and sunshine and buy more of it. Then the market crashes and they sell their funds at a huge loss. The thing with index funds is that they indeed fluctuate over the months and years, but over the course of decades there is a very clear trend.

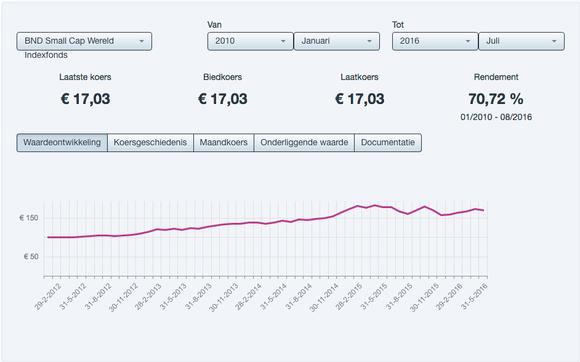

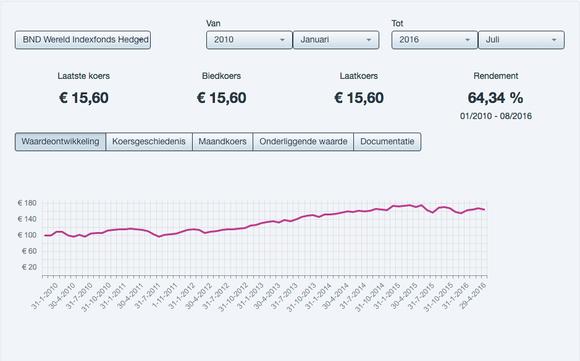

Here are the graphs of some of the index funds I use. Note the bumps caused by crises etc and how they impact the graph very much short term, but not so much the trend.

Smallcap index fund:

World government and corporate bond index fund:

If you look at your stocks daily, they will seem to fluctuate wildly. When I was reading about this I has a memory flash to the session we had from billionaire Tim Draper’s financial manager. He drew us exactly these graphs, saying we should ignore the news and ignore day traders. Over the long term these things grow.

Important note here: the past doesn’t reflect the future. There is no guarantee these products continue to make sense. In my mind though the failing of index finds means a failing of the market, which means the world is screwed anyway.

Buffer emotion using a plan

Know thyself. Personally I like optimizing things, if I would look at my investments daily or even weekly I would make bad impulse decisions that seem to make sense at the time.

Buffer your emotional nature by making a plan beforehand. For me it’s simple: put whatever money I can into my traditional low risk long term investment accounts.

I get to play and go crazy with a small portion of money, just for the fun of it. The bulk of my income goes to low risk, high yield investments.

Section 3: How I actually invest

The below techniques are a blend of the books I have read and the advice I received from people I trust. That is not to say I recommend you copy paste this to your own finances. I never give financial advice, I am not responsible for your financial success or failure. You are however welcome to grab from my investment style what makes sense for you and discard the rest.

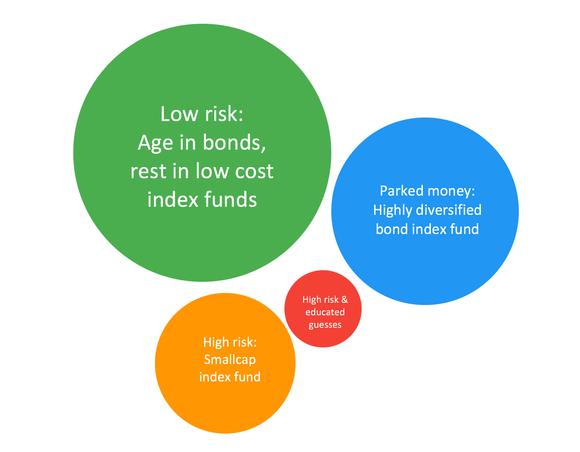

Four investment buckets

Like with my spending I compartmentalize my investments into categories:

- Temporary account to ‘park’ money on (low risk)

- Traditional regular risk

- Traditional high risk

- Risky investments

In these accounts I use the following investment accounts:

- **Parking money: **this is 100% bonds. I put money in here that would otherwise be on a low-yield savings account. Things like the money I plan to pay off my study debt.

- Traditional (regular): about my age in bond index funds and the rest in low cost world index funds. Currently that thus means I keep 30% of that account in low cost bond indexes and 70% in a low cost world index fund

- Traditional (risk): 100% index fund of small-cap companies (smaller companies, but still established). I’m considering adding an emerging market index find but need to do some more research.

- Risk: These cover things that most people don’t understand. Things like crypto currencies and other high tech and high risk opportunities. Personally I love projects like Ethereum, which netted me a 5000% return on investment.

Personally the majority of my investments is in the ‘traditional regular risk’ and a smaller amount on the ‘traditional high risk’. The super risky investments like Ethereum I start with money I have on ‘parked’ accounts and then leave in there over a longer term.

Companies I invest with

In general, I’m a fan of financial products by Vanguard. They offer great low cost index funds for many regions. You often can’t buy from Vanguard directly, to buy their products you need to become a customer at a financial institution that offers their products. Beware of the fees they charge!

Personally I use a Dutch company called Brand New Day, which supports monthly automatic investments. For the states I know Wealthfront is a popular choice.