If you have enough invested money, you can live off of the interest. That is what this post is about: how to make money work for you, when you are doing nothing. So you don't have to do anything.

Disclaimer: this is what I've learned and how I invest my money. I am not responsible for your decisions. Do your own research and make your own decisions.

Summary

- Invest your money now so you get much more later

- Low cost index funds are the way to go

- Calculate what yearly income you need to never work again

- Calculate how much you need to invest reach that (use this tool)

- Automate your finances as much as possible

Investing is giving money now to get more later

Let's say I have 10 chickens that produce an egg a day each, which I can sell for €10 to my neighbours. That means I have a €10 daily income. This would equal 10*365 = €3650 a year.

You have €1000 available. You offer to give me this €1000,- in return for 25% of my eggs (which would give you €2.50 every day).

When you buy shares in a company, you are buying their future profits.

This would give you 2.50*365 = €912.50 every year. So after 2 years you would have €1825 which is a lot more that the €1000 you gave me. So why would I agree to trading your money for 25% of the profits? Well perhaps I:

- Want to buy more chickens so I make even more money

- I am short on cash and need money now rather than later

- I took out a loan to buy the chickens, and want to pay it back

Buying a portion of a company is risky, buy a market instead (index fund)

Let's say we buy 5 of the 100 stocks of Acme Incorporated. So long as Acme does well we will gain 5/100 = 5% of their substantial profits. But what if Acme goes bankrupt? Then we lose it all... Instead of buying shares in a company, we can buy shares of an index fund.

An index fund buys the top performing companies in a region/sector.

For example the S&P 500 index fund buys shares in 500 big and reliable companies on the US market. If you buy 1 share in the S&P 500 index you in essence own a small portion of 500 companies.

An index fund is basically like betting on the 500 companies that have proven to generate profits.

Why is this good? If one of the companies fails, the other 499 are still up and running. You spread your risk across many ventures without having to manage a complex share portfolio. Examples of an index 'market' are:

- Big US companies (S&P 500)

- Smaller companies that look like they will grow (Vanguard Global Small Cap)

- Sustainable companies (Sustainable Europe Index Fund)

- Companies in healthcare (Vanguard Health Care Index Fund)

Check out Warren Buffet's opinion on index funds:

You can also loan money to governments (bond index fund)

Bonds are loans. You offer the bond issuer money right now, and they promise to give you back a set amount later. Common bond issuers are governments and corporations.

A government bond allows you to give a government money, and at the end of the term they give you back more.

So what if a government can't pay you back? It has happened before (Greece, Iceland etc) and will certainly happen again. You can buffer against this by buying an index of bonds.

A share of a bond index means you are investing small amounts in many bonds at the same time.

If you invest in a bond index you are at less risk of a government failing to pay their debts.

You need 25x your desired yearly income

For example if you want €20,000 of yearly income (equals €1667/month) you need to reach €500.000 of invested value. This is because based on a 4% return from your investments you get 500.000*0.04= €20,000.

The goal of investing money is that you can live on a set sum of money without working.

If your money is generating new money, this means it will never run out. So to retire you don't need to plan for how long you live. There are other factors like lifestyle, but the essence remains the same.

Always calculate how much income you need to survive

Calculate how much money you need to survive, how much you need to live well and how much you need to live what you consider your perfect life.

I for example can survive in Amsterdam on €800 rent, €400 food and €400 fun. That would mean I need €1600 a month, which equals €19,200 per year.

Whatever you desire, always calculate what exactly that means.

Sometimes the life you dream of is a lot cheaper than you would think. For example, living on a beach and surfing every day can be done for a couple hundred a month if you are willing to live in Thailand or a surf worthy South American country.

Assuming 4% a year is reasonable

Many people initially take issue with the idea of reliable 4% returns, because bank interests are currently so low. Here are some stats to change your mind:

| Metric | Value |

|---|---|

| S&P 500 average return 1928-2016 | 11.42% |

| Academic safe withdrawal limit | 4% |

| Portfolio dependent rates | 3-9% |

If you want to plan your investments well, you need to look at the long term big picture.

Investing is a marathon, not a sprint.

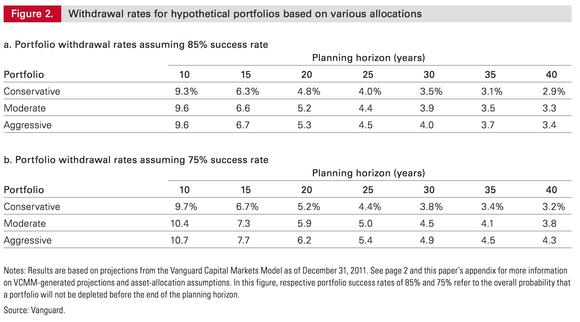

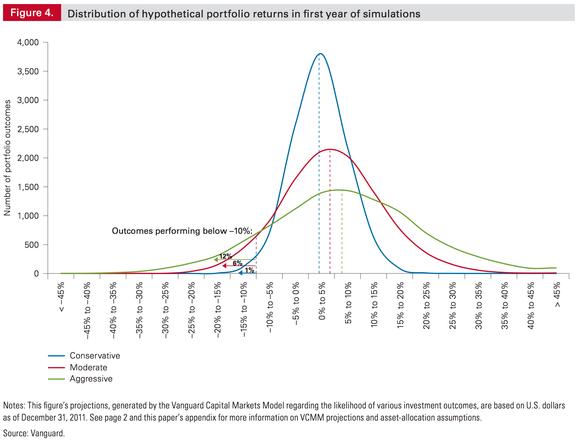

Whether or not the 4% holds up depends on the stock market performance and the aggressiveness of your portfolio. More bonds means more conservative, more stocks means more aggressive.

Check out for example these projections from Vanguard (taken from this paper:

The 'success rate' is whether or not the portfolio generated enough to keep your initial amount. Since the stock market fluctuates sometimes it will generate more, and sometimes less.

You don't need to make €500,000 to get it

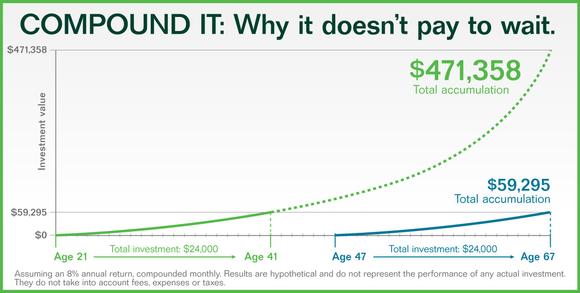

When you invest, your returns will be compounded. This year you get returns on your money, next year you get returns on the returns of last year as well! This is way more powerful than you think.

€100 invested in the S&P 500 in 1928 would be €328,645.87 in 2016

One could argue that the above is an extreme example, but the concept holds true. Compound interest gives you more money the longer you have it invested.

Here are some demo calculations (assuming 4% returns):

| Monthly investment | Years | Total invested | Outcome |

|---|---|---|---|

| €500 | 30 | €180,000 | €349,970 |

| €500 | 40 | €240,000 | €592,959 |

| €1000 | 30 | €360,000 | €699,940 |

| €1000 | 40 | €480,000 | €1,185,918 |

Use a tool to calculate how much you should invest

I wrote a little browser-based tool you can use to calculate how much you need to invest to get to a certain amount of automated income. This is not hard science, but a projection to help you plan ahead.

Click here to use the free tool.

You can buy these funds easily

Depending on the country you will have to go through a broker, or you can buy straight from the provider. In the US for example you can buy from Vanguard directly. In the Netherlands I go through a company called Brand New Day.

Be very careful with fees!

Don't take your bank/broker fees for granted They have a huge impact. My provider charges me a yearly fee of 0.15% for example. Have a look at the impact of fees if you invest €100,000 for 30 years with a 7% return rate.

| Invested | Fee | Outcome |

|---|---|---|

| €100,000 | 1% | €574,349 |

| €100,000 | 2% | €432,194 |

| €100,000 | 3% | €324,340 |

The difference between a fee of 1% and 3% is over €100,000! Take your time to find a good provider that charges low fees. it will pay off massively in the long term.

Decide on a strategy and stick to it

Humans are not good at managing emotions when it comes to money. Since the stock market it bound to go up and down, you need to make sure you buffer against making bad decisions.

If for example there is a downturn in the financial market, you should not allow yourself to even consider selling any of your investments. Not if you set up a good diversified strategy.

If you want to talk to a financial advisor, be sure to talk to a fiduciary, not just any financial advisor. See video below.

Automate investments on a monthly basis

You should be automating your finances as much as possible. Not only will this buffer your emotional reactions to stock market changes, but it will cause a cost averaging effect.

For a detailed overview of how I automate my money see this article.